the

|

|

|

| Preliminary Proxy Statement |

☐ |

|

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

☒ | ||||

| ||||

No fee required. | ||||

☐ | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

Fee paid previously with preliminary materials. | ||||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act | |||

| ||||

| ||||

| ||||

| ||||

A Message from Our CEO

Chairperson

Dear American Homes 4 RentAMH shareholders:

“There’s no place like home.” At the endAs I transition out of my role as Chairperson of the classic movie The WizardBoard this year, I want to personally thank you for your support and confidence in our ongoing mission to simplify the way America lives. After 10 years of Oz, this isserving on the realization that comes to DorothyBoard, and as she wakes up from her elaborate dream. For mostone of us, if there was ever a year in which Dorothy’s insight was true, it had to have been 2020. Homes became our schools, our offices, our vacation destinations, our escapes from long commutes and our safe havens. And we at American Homes 4 Rent were there to meet eachits original members, I feel tremendously proud of these needs, and others:

For many inSince 2012, we have transformed the real estate sector 2020 wasby proving a difficult year, but our business model set us apart:

Today, we are recognized as a top national homebuilder and operator that is contributing solutions to America’s greatest housing challenges, and providing a reliable, flexible alternative to residents across the country. Ten years after our initial public offering, we have grown from first rental daya team of about 160 employees to exit interviews help enableapproximately 1,800, and a portfolio of 14,000 homes to nearly 59,000.

In 2022, we delivered more than 2,000 homes, opened our 130th community, and purchased or optioned over 3,000 additional land lots, bolstering a robust pipeline and runway of growth into 2023 and beyond. We closed the year with revenues of nearly $1.5 billion and an increase in core funds from operations per share of 13% over the prior year.

We also served approximately 200,000 residents in over 20 states, who continue to put their trust in us to respond to—provide an elevated rental experience. And we advanced our commitment to the environment, to corporate governance,

and even anticipate—issuesto social responsibility, in service—too—of a greener and enhancebrighter future for American housing.

Now, supported by this robust foundation, AMH is uniquely positioned to continue leading the industry into its next chapter by focusing on the fundamentals it has long stood for: providing a path for households to access single-family living, meeting growing demand with steady supply, and delivering peace of mind to our resilienceresidents, as well as to our employees and market intelligence; and

In order to continue making a positive impact into the future, we ask for your voting support on the proposals detailed in this proxy statement. We encourage you to review each proposal closely before voting.

This year, we are once again hosting our own people—whether via our hire-locally practices or our proprietary training programs and our focus on individual development—creates a culture in which everyone can be themselves and give their best.

Annual Meeting of Shareholders virtually. On behalf of the Board of Trustees, I am pleased to invite you to our 2021 Annual Meeting of Shareholders. The meeting will be heldjoin us on Thursday,Tuesday, May 6, 2021,9, 2023, at 9:00 a.m., Pacific Time. Due to public health concerns regarding the COVID-19 pandemic, the Annual Meeting will be held in virtual-only format. You may attend the meetingTime, virtually or by proxy. You will be able to attend and participate, in the virtual Annual Meeting, vote your shares electronically and submit your questions during the meeting by visiting: www.virtualshareholdermeeting.com/AMH2021.

The matters to be considered at the meeting are described in detail in the attached notice of meeting and proxy statement. You are encouraged to review them before voting.

We ask for your voting support on the items we describe in this proxy statement so we can continue making the world a better place for our residents, our employees and you, our investors.

AMH2023. Your vote is important and we urge you to cast your voteit as soon as possible. You may vote your shares over the Internet,online, by telephone or byvia mail by following the instructions on the proxy card or voting instruction form by signing, dating and returning the enclosed proxy card. If you attend the virtual Annual Meeting, you may revoke your proxy at the meeting and vote your shares virtually. If you have any questions, please contact D.F. King & Co., Inc., our proxy solicitor assisting us in connection with the 2021 Annual Meeting. Shareholders in the U.S. and Canada may call toll-free at (877) 283-0321. Banks and brokers may call collect at (212) 269-5550.

We appreciate your continued trust and confidence as an investor in American Homes 4 Rent.

Sincerely,

Kenneth M. Woolley

Chairperson of the Board

March 24, 2023

A Message from Our CEO

Dear AMH shareholders:

This year marks a big milestone for us. We are celebrating ten years as a public company dedicated to redefining what it means to make a home yours. Throughout economic cycles and volatile markets, we have remained resilient and steadfast in our mission to deliver the joys of single-family living to residents nationwide, with support and convenience they can count on.

Since our origins, we have believed that people who want to live in a home deserve a better option. They deserve more flexibility than being locked into a 30-year mortgage. They deserve to sleep more soundly at night, without worrying about looming property taxes or expensive repairs. Buying a home may not be right for everyone. But everyone should be able to live in one, comfortably.

We also believe that, when it comes to leasing a home, the choices have not always been ideal. Faced with unreliable landlords, poorly maintained properties, remote locations, and high-density neighborhoods, among many other challenges, home renters in the U.S. have never had it easy. And that is where we come in.

In 2012, we set out to make leasing a high-quality home simpler for residents nationwide. For the past decade, we have worked to simplify their world, so that they can focus on what really matters to them, wherever they are in life.

Today, we manage over 60,000 rentals in attractive locations nationwide, home to approximately 200,000 people. We provide online tools and solutions to make finding and living in a home they love as seamless as possible. We offer professional management and maintenance services, so they can enjoy their weekends stress-free.

As the 41st largest homebuilder in the nation, we also develop new communities and neighborhoods that add housing supply during an ongoing shortage, and are thoughtfully designed to support their comfort, wellness, and sense of belonging.

More than ever, Americans are looking to us to find desirable homes that they can access, in the regions where they want to live and work. In turn, we are meeting them with reliable solutions to their housing needs, delivering peace of mind amid widespread uncertainty.

And we are doing it all with care, for our residents, as well as each other, and the planet we collectively share.

Since last year’s report, we opened our first solar-enabled community, conducted a formal climate change risk analysis to better mitigate our environmental impact, established six Employee Resource Groups, implemented a corporate social

responsibility platform to connect employees with nonprofit and volunteer opportunities in their communities, and supported a planned affordable housing development through a charitable donation.

As a result of our continued sustainability efforts, we were recently named one of America’s Most Responsible Companies by Newsweek and Statista Inc. and a Great Place To Work® for the second year in a row, as well as one of Fortune’s 2022 Best Workplaces in Real Estate™ on its inaugural list. Guided by our values of making it simple, caring about people, and holding ourselves accountable, we have earned recognition for doing business sustainably, being socially responsible, and providing a service to our customers with integrity.

Now, in our second decade as a leading housing provider, we have updated our brand to reflect the journey that has brought us here. To reflect the simplicity that we strive to deliver to our residents’ lives daily. To reflect the innovative spirit of our origins and of the team that has made it all possible. To reflect our heritage and our vision of better housing in America, one with more possibilities, choices, and freedoms.

Today, we do much more than just rent homes. We work to improve people’s lives. And our new brand, under the simplified look, feel, and name of AMH, represents our renewed commitment to serving our customers by making their worlds a little easier and brighter every day, wherever they choose to call home.

As we continue our journey, we remain committed to being a resilient, sustainable, and inclusive organization to earn the trust of those who rely on us—and delivering lasting value to you, our shareholders, as well as our residents and employees. And we look forward to unveiling new ways to bring our original mission to life: new offerings and services to elevate the experience of home, new technologies to remove friction from the customer experience, and new solutions to make single-family living more accessible to more people.

The future of housing in America is bright with opportunity. And AMH will continue to be there every step of the way to build it better.

Sincerely,

David P. Singelyn

Chief Executive Officer and Trustee

March 24, 2023

Notice of the 20212023 Annual

Meeting of Shareholders

| Date and Time

|   | Virtual Location

Visit: | |||||||||

Items of Business

1 | To elect as trustees the | |

2 | ||

| To ratify the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, | |

| To hold a non-binding, advisory vote to approve our named executive officer compensation; | ||

| To consider and act upon any other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. | |

Recommendations of the Board

The Board of Trustees (the “Board”) unanimously recommends that you vote “FOR” each of the trustee nominees named in the attached proxy statement, “FOR” approval of the adoption of the 2021 Incentive Plan, “FOR” approval of the adoption of the ESPP, “FOR” ratification of the appointment of Ernst & Young LLP and “FOR” approval, on an advisory basis, of our named executive officer compensation, and “ONE YEAR” with respect to the advisory vote on the frequency of future advisory votes on executive compensation. Detailed information concerning these proposals is included in the accompanying proxy statement.

Proxy Materials

The Noticenotice of Meeting, Proxy Statementmeeting, proxy statement and Annual Report on Form 10-K are available free of charge at: www.ah4r.com/Investors/AnnualMeetingDocs2021.https://investors.amh.com/financials/annual-reports. The proxy statement and accompanying proxy card are being sent or made available to you on or about March 24, 2023.

Record Date

You are entitled to vote at the meeting if you were a shareholder of record at the close of business on March 9, 202113, 2023 of our Class A or Class B common shares of beneficial interest, par value $0.01 per share.

Voting

Your vote is very important. To ensure that your shares are represented at the Annual Meeting, please vote over the Internet, by telephone or by mail as instructed on the proxy card or voting instruction form you receive. You may revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the accompanying proxy statement.

2023 Proxy Statement

By Order of the Board of Trustees,

Sara H. Vogt-Lowell

Chief Legal Officer and Secretary

March 22, 202124, 2023

If you have questions about the matters described in this proxy statement, how to submit your proxy or if you need additional copies of this proxy statement, you should contact D.F. King, the company’s proxy solicitor, toll free at (877) 283-0321 (banks and brokers may call collect at (212) 269-5550).

Important Notice Regarding Availability of Proxy Materials for the 20212023 Annual Meeting:Meeting on May 9, 2023: This Proxy Statement and our 20202022 Annual Report on Form 10-K are available on the company’s website www.americanhomes4rent.comwww.amh.com under ”Investor“Investor Relations.”

2023 Proxy Statement |

2023 Proxy Statement

41 | ||||

41 | ||||

41 | ||||

41 | ||||

42 | ||||

43 | ||||

44 | ||||

45 | ||||

47 | ||||

Role of Management and Board in Determining the Compensation of Executive Officers | 48 | |||

48 | ||||

48 | ||||

49 | ||||

50 | ||||

50 | ||||

50 | ||||

50 | ||||

50 | ||||

51 | ||||

52 | ||||

53 | ||||

54 | ||||

54 | ||||

54 | ||||

54 | ||||

54 | ||||

55 | ||||

55 | ||||

57 | ||||

58 | ||||

61 | ||||

64 | ||||

64 | ||||

64 | ||||

65 | ||||

2023 Proxy Statement

In 2022, we were named the 41st largest homebuilder in the U.S. by Builder100. |

| ||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

|

| ||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

| |||||||

|

| ||||

| ||||

| ||||

| ||||

| ||||

|

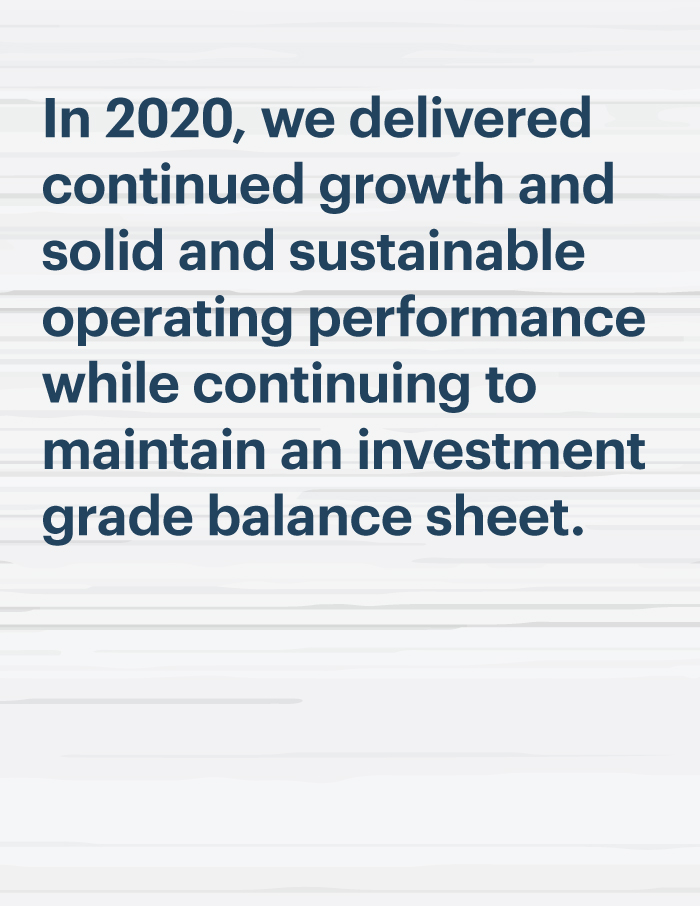

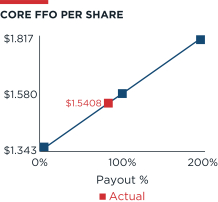

* ReferSee pages 30 to the company’s 202039 and 46 to 47 of our Annual Report on Form 10-K for a detailed discussion of our financial results for 2022, as well as information regarding Core FFO (p. 41-43) and Core NOI, (p. 31-33), which are non-GAAP performance measures.

Building for the Future

Because we build our homes to rent, we design them for long-term durability. ThisBuilding communities at scale saves resources and lowers our total costs. Our attention to detail in planning and construction results in homes that function with excellent energy efficiency and minimal maintenance costs, including maintenance.benefitting all stakeholders. Our renewable energy initiatives are steps toward addressing lower GHG emissions across the portfolio.

|

|

| ||||||

|

|

| ||||||

|  |

Delight residents, engage employees, foster community

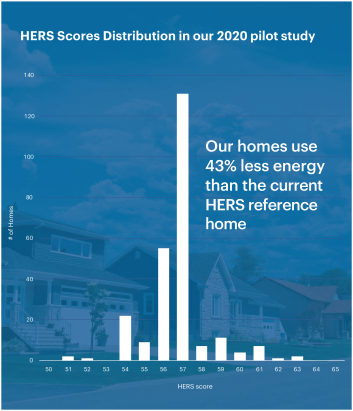

Our success dependsHERS energy efficiency ratings:

We utilize certified third-party raters and the Home Energy Rating System (“HERS”) to track the energy efficiency of all our newly built homes. For 2022, the average HERS index for our newly constructed homes was 61.9, which means they use nearly 38.1% less energy than a home built to the 2006 “reference home” standard and less than half the energy of a typical home in this country.

Environmentally-friendly construction:

We use long-lasting flooring, energy-efficient LED lighting, low-flow water fixtures and other eco-conscious features designed to last for decades, both in our newly constructed homes and as we renovate our legacy homes.

Renewable energy program:

We expanded our renewable energy program by installing solar panels on an additional community amenity center and on the roofs of all 86 homes across a newly built community.

Environmental Management System (“EMS”):

In 2022, we completed implementation of an EMS for our employees delighting residents withAMH Development homebuilding operations to help ensure we identify, monitor and reduce our environmental risks and impacts.

2023 Proxy Statement | 3

We Care About People

We believe in fostering strong communities for a sustainable society. And we know that this work always starts from within. We are cultivating a people-first culture where we take care of each other, so that together we can take care of the people who make our houses that become their homes. This requires us to attract, retain and grow a skilled and diverse workforce to design and maintain high-quality homes.

|

provide networking opportunities and raise cultural awareness. We | |

|

| |

|

| |

|

| |

|

Injury Illness Protection Plan for all employees. Our OSHA Recordable Incident Rate | |

|

| |

| Training and development: We expanded our leadership and technical skills training programs, including through our new AMH DevPro Training for all construction project managers to ensure they embrace the long-term owner mindset of build-to-rent construction. Additionally, in 2022 we launched our company-wide employee tuition reimbursement program. |

| Resident support: In addition to monitoring Google review scores and conducting regular internal surveys, we conducted our second third-party customer satisfaction survey. As a result of our first survey in 2021, we addressed the opportunities identified to make living in our homes as simple as possible. The second survey in 2022 helped inform how we are doing in achieving this goal and set reference benchmarks in customer engagement for our company and our industry. |

2022 training highlights | 92K hours of training provided | 51 average hours of training | ||

4 | AMH

LeadLeading with integrity and transparencyIntegrity

We long-term value for all our stakeholders. |  | |||||

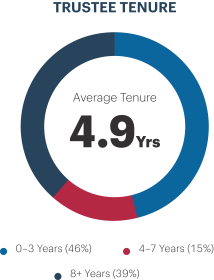

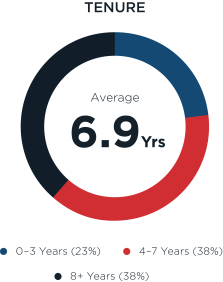

| 3 new trustees added since 2020 6.9YRS average tenure of trustees SASB, TCFD, GRI ESG framework reporting | |||||

| Good | |||||

| Board refreshment: We are committed to regular board refreshment. Since the beginning of 2020, we have added three new trustees, | |||||

| Board oversight of ESG: | |||||

|

| |||||

| ||||||

Cybersecurity: In order to protect our residents, employees, vendors and investors in the digital age, we prioritize cybersecurity and data privacy risk oversight and ensuring compliance with legal standards for the collection and use of personal information, on which we train our employees annually. | ||||||

2023 Proxy Statement | 5

This proxy statement contains important information regarding the 20212023 Annual Meeting of Shareholders (the “Annual Meeting”). Specifically, it identifies the proposals on which you are being asked to vote, provides information that you may find useful in determining how to vote, and describes voting procedures. This proxy statement is being sent or made available to you on or about March 22, 2021.24, 2023.

The Notice of Meeting, Proxy Statement and Annual Report on Form 10-K are available free of charge at:

www.ah4r.com/Investors/AnnualMeetingDocs2021.https://investors.amh.com/financials/annual-reports.

Date and Time: Thursday, Tuesday, May 6, 2021,9, 2023, at 9:00 a.m., Pacific Time.

Virtual Location: www.virtualshareholdermeeting.com/AMH2021.AMH2023. To be admitted, you must enter the control number found on your proxy card or voting instruction form.

Record Date: You are entitled to vote at the Annual Meeting if you were a shareholder of record at the close of business on March 9, 202113, 2023 (the “Record Date”) of our Class A or Class B common shares of beneficial interest, par value $0.01 per share.

Voting: Your vote is very important. To ensure your representation at the meeting, please vote over the Internet, by telephone or by mail as instructed on the proxy card or voting instruction form you receive. You may revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the accompanying proxy statement.

|  |  |  | |||||||||||||||||

| ||||||||||||||||||||

VIRTUALLY VIRTUALLY |  INTERNET INTERNET |  MAIL MAIL |

|  TELEPHONE TELEPHONE | ||||||||||||||||

www.virtualshare holdermeeting.com/ AMH2023 | www.proxyvote.com | Return your proxy in the postage-paid envelope provided | 1-800-690-6903 | |||||||||||||||||

| You may vote your shares virtually at the Annual Meeting. Even if you plan to attend the Annual Meeting virtually, we recommend that you submit the accompanying proxy card or voting instruction form or vote via the Internet or by telephone by the applicable deadline so that your vote will be counted if you later decide not to attend the Annual Meeting. | You may vote your shares through the Internet by signing on to the website identified on the proxy card or voting instruction form and following the procedures described on the website. Internet voting is available 24 hours a day until 11:59 p.m. Eastern Time on the day before the Annual Meeting. If you vote through the Internet, you should not return any proxy card. | If you choose to vote by mail, simply complete the accompanying proxy card or voting instruction form, date and sign it, and return it in the pre-addressed postage-paid envelope provided. | You may vote your shares by telephone by following the voting instructions on the enclosed proxy card or voting instruction form, respectively. Telephone voting is available 24 hours a day until 11:59 p.m. Eastern Time on the day before the Annual Meeting. | |||||||||||||||||

6 | AMH |

As summarized below, there are distinctions between shares held of record and those owned beneficially:

| • | Shareholder of Record—If your shares are registered directly in your name, you are considered the shareholder of record of those shares. As the shareholder of record, you can submit your voting instructions by Internet, telephone or mail as described on the enclosed proxy card. |

| • | Beneficial Owner—If your shares are held through a broker or bank in “street name” as of the close of business on the Record Date, you can either: |

(i) vote your shares by delivering the enclosed voting instruction form in the pre-addressed postage-paid envelope provided or (ii) contact the person responsible for your account to ensure that a voting instruction form is submitted on your behalf. In most instances, you will be able to do this over the Internet, by telephone or by mail as indicated on your voting instruction form. It is critical that you promptly give instructions to your brokerage firm, bank or other nominee. You may vote your shares at the virtual meeting only if you obtain a legal proxy from your brokerage firm, bank or other nominee. |

If you require assistance in changing, revoking or voting your proxy, please contact the company’s proxy solicitor:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, New York 10005

Banks and Brokers Call Collect: (212) 269-5550

All Others Call Toll-Free: (877) 283-0321

Email: AMH@dfking.com

Unanimous Recommendations of the Board

1 | Election of the | BOARD RECOMMENDATION |

| FOR | ||||||

2 |

|

|

| |||||||

|

|

|

| |||||||

| Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, | BOARD RECOMMENDATION |

| FOR | ||||||

| Advisory Vote to Approve our Named Executive Officer Compensation |

|

| |||||||

|

|

|

| |||||||

These proposals are discussed in more detail in this proxy statement and you should read the entire proxy statement carefully before voting. We will also consider any other matters properly brought before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

These proposals are discussed in more detail in this proxy statement and you should read the entire proxy statement carefully before voting. We will also consider any other matters properly brought before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

2023 Proxy Statement | 7

For the second consecutive year, due to public health concerns regarding the COVID-19 pandemic, theThe Annual Meeting will be held in virtual-only format. You will be able to attend and participate in the virtual Annual Meeting, vote your shares electronically and submit your questions during the meeting by visiting: www.virtualshareholdermeeting.com/AMH2021.AMH2023.

We believe this virtual format will enhance shareholder participation, as shareholders will be able to attend the Annual Meeting and engage in the live, online Q&A session from any convenient location. Conducting the meeting virtually will ensure shareholder access to management despite the ongoing uncertainty related to the COVID-19 pandemic.

The Annual Meeting will begin with a pre-recorded presentation, followed by a live webcast of the formal business of the Annual Meeting and a Q&A session.

To be admitted to the Annual Meeting, you must enter the control number found on your proxy card or voting instruction form. If your common shares are held through a broker or bank in “street name” as of the close of business on the record date,Record Date, you may vote your shares at the virtual meeting only if you obtain a legal proxy from your brokerage firm, bank or other nominee.

You may vote your shares virtually at the Annual Meeting. To vote at the virtual Annual Meeting, you must re-enter the control number found on your proxy card or voting instruction form. Even if you plan to attend the Annual

Meeting virtually, we recommend that you submit the accompanying proxy card or voting instruction form or vote via the Internet or by telephone by the applicable deadline

so that your vote will be counted if you later decide not to attend the virtual Annual Meeting.

As part of the Annual Meeting, we will hold a live, online Q&A session, where shareholders of record of our Class A or Class B common shares at the close of business on the Record Date will be allowed to ask questions. You may submit questions in real time during the Annual Meeting. We intend to answer all questions submitted before or during the Annual Meeting which are pertinent to the company and the Annual Meeting matters, as time permits. Consistent with our prior virtual and in-person annual meetings, all questions submitted will be generally addressed in the order received, and we limit each shareholder to one question in order to allow us to answer questions from as many shareholders as possible.

If there are matters raised of individual concern to a shareholder, or if a question posed was not otherwise answered, we provide an opportunity for shareholders to contact us separately after the Annual Meeting through the company’s website, www.americanhomes4rent.comwww.amh.com under ”Investor“Investor Relations.”

If you encounter any difficulties accessing or participating in the virtual Annual Meeting, please call the technical support number that will be posted on the Annual Meeting Website log-in page.

|

Who We Are

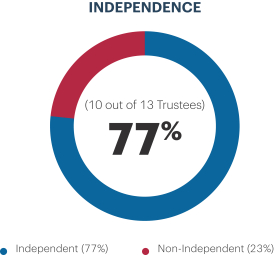

Our Board of Trustees (the “Board”)currently consists of thirteen members. TenEleven of the current trustees are considered “independent” and all members of our Audit Committee, Nominating and Corporate Governance Committee and Human Capital and Compensation Committee are independent.

Despite challenges faced during the COVID-19 pandemic, we continued to grow Mr. Woolley, our Chairperson of the Board, will retire from our Board as of the 2023 Annual Meeting pursuant to support the success of our long-term strategy. Since January 2020, we added three new independent trustees, all of whom bring extensive operational and executive experienceTrustee Retirement Policy, which provides that no trustee will be nominated for election to the Board and twounless he or she will be 75 or younger on the first day of whom enhance the diversitynew Board term. Mr. Hart, an independent trustee, will assume the role of our Board. During 2020,Chairperson following the Board also formalized oversight responsibility with respect to important ESG matters,

engaged in deeper conversations on key strategic issues and worked closely with management to pursue the company’s key objectives.2023 Annual Meeting.

Our Board believes its members collectively have the experience, qualifications, attributes, and skills to continue

to effectively oversee the management of the company, including a high degree of personal and professional integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to appreciate the issues facing the company, a willingness to devote the necessary time to Board duties, a commitment to representing the best interest of the company and a dedication to enhancing shareholder value. The Board regularly monitors and evaluates its composition to ensure that it continues to support the success of our long-term strategy.

The Board unanimously recommends a vote “FOR” each of the thirteentwelve nominees proposed by the Board.

Nominee | Age | Principal Occupation | Trustee Since | Committee Membership | Age | Principal Occupation | Trustee Since | Current Committees | ||||||||

Kenneth M. Woolley * | 74 | Chairperson of the Board, American Homes 4 Rent

Founder and Chairperson, Extra Space Storage, Inc. | 2012 |

| ||||||||||||

Matthew J. Hart * | 71 | Incoming Chairperson of the Board, AMH Retired President and Chief Operating Officer, Hilton Hotels Corporation | 2012 | • Human Capital and Compensation (Chair) • Nominating and Corporate Governance | ||||||||||||

David P. Singelyn | 59 | Chief Executive Officer, American Homes 4 Rent | 2012 |

| 61 | Chief Executive Officer, AMH | 2012 |

| ||||||||

Douglas N. Benham * | 64 | President and Chief Executive Officer, DNB Advisors, LLC | 2016 | • Nominating and Corporate Governance (Chair) • Human Capital and Compensation | 66 | President and Chief Executive Officer, DNB Advisors, LLC | 2016 | • Nominating and Corporate Governance (Chair) • Human Capital and Compensation | ||||||||

Jack Corrigan | 60 | Chief Investment Officer, American Homes 4 Rent | 2012 |

| 62 | Retired Chief Investment Officer, AMH | 2012 |

| ||||||||

David Goldberg | 71 | Retired Executive Vice President, American Homes 4 Rent | 2019 |

| ||||||||||||

David Goldberg * | 73 | Retired Executive Vice President, AMH Former Senior Vice President and General Counsel, Public Storage | 2019 |

| ||||||||||||

Tamara Hughes Gustavson * | 59 | Real Estate Investor

Philanthropist | 2016 |

| ||||||||||||

Matthew J. Hart * | 69 | Retired President and Chief Operating Officer, Hilton Hotels Corporation | 2012 | • Human Capital and Compensation (Chair) • Nominating and Corporate Governance | ||||||||||||

Tamara H. Gustavson * | 61 | Real Estate Investor

Philanthropist | 2016 |

| ||||||||||||

Michelle C. Kerrick * | 58 | Former West Region Market Leader and Managing Partner of the Los Angeles office of Deloitte & Touche LLP | 2020 | • Audit • Human Capital and Compensation | 60 | Former West Region Market Leader and Managing Partner, Deloitte & Touche LLP | 2020 | • Audit • Human Capital and Compensation | ||||||||

James H. Kropp * | 72 | Retired Chief Investment Officer, SLKW Investments, LLC and Microproperties LLC | 2012 | • Audit (Chair) | 74 | Retired Chief Investment Officer, SLKW Investments LLC and Microproperties LLC | 2012 | • Audit (Chair) | ||||||||

Lynn C. Swann * | 69 | Director for Athene Holding Ltd. and Evoqua Water Technologies | 2020 | • Audit • Nominating and Corporate Governance | 71 | Director for Apollo Global Management, Inc. and Evoqua Water Technologies | 2020 | • Audit • Nominating and Corporate Governance | ||||||||

Winifred M. Webb * | 65 | Founder, Kestrel Advisors Former Senior Executive, Ticketmaster, and The Walt Disney Company | 2019 | • Human Capital and Compensation • Nominating and Corporate Governance | ||||||||||||

Jay Willoughby * | 64 | Chief Investment Officer, TIFF Investment Management | 2019 | • Audit • Nominating and Corporate Governance | ||||||||||||

Matthew R. Zaist * | 48 | Chief Executive Officer, The New Home Company | 2020 | • Audit • Human Capital and Compensation | ||||||||||||

Nominee | Age | Principal Occupation | Trustee Since | Committee Membership | ||||

Winifred M. Webb * | 63 | Chief Executive Officer, Kestrel Advisors

Former Senior Executive, Ticketmaster, and | 2019 | • Human Capital and Compensation • Nominating and Corporate Governance | ||||

Jay Willoughby * | 62 | Chief Investment Officer, TIFF Investment Management | 2019 | • Audit • Nominating and Corporate Governance | ||||

Matthew R. Zaist * | 46 | Former Chief Executive Officer and Director, William Lyon Homes | 2020 | • Audit • Human Capital and Compensation | ||||

* Denotes “independent” member of the Board.

2023 Proxy Statement | 11 |

Biographical Information About Our Trustee Nominees

Set forth below is biographical information for each of the trustee nominees, including a list of the specific qualifications that were considered for membership on our Board. Each nominee has consented to be named in this proxy statement and to serve if elected.

Age:

Trustee since: 2012

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

|

| |||

|

| |||

|

| |||

|

| |||

• Human Capital and Compensation (Chair)

• Nominating and Corporate Governance | Incoming Chairperson of the Board, AMH Retired President and Chief Operating Officer, Hilton Hotels Corporation

Mr. Hart brings to our Board deep management, operational, executive compensation, corporate governance and real estate industry experience from his executive roles at a number of publicly traded real estate and consumer companies. His experience, qualifications, attributes, and skills qualify him to serve as chair of our Human Capital and Compensation Committee, a member of our Nominating and Corporate Governance Committee and a member of our Board. | |||

Background

• Hilton Hotels Corporation, President and Chief Operating Officer, Executive Vice President, Chief Financial Officer

• Walt Disney Company (NYSE: DIS), Senior Vice President and Treasurer

• Host Marriott Corp., Executive Vice President and Chief Financial Officer

• Marriott Corporation, Senior Vice President and Treasurer

• Bankers Trust Company, Vice President, Corporate Lending

Public Directorships

• American Airlines (NASDAQ: AAL)

• Air Lease Corp. (NYSE: AL)

|

• B.A. in Economics and Sociology, Vanderbilt University

• M.B.A. in Finance and Marketing, Columbia University

Qualification Highlights:

• Executive Leadership

• Real Estate Experience

• Treasury/Capital Allocation

• Finance/Accounting/Auditing

• Consumer Experience

• Human Capital Management

• Corporate Governance

• Risk Assessment & Management

• Investor Relations

• Public Company Board • Public Company Senior Management Experience • Audit Committee • Cybersecurity • Capital Markets | |||

Age:

Trustee since:

|

Mr. Singelyn has more than three decades of experience leading residential and single-family rentals with nearly 60,000 homes. His experience, qualifications, attributes, and skills qualify him to serve as a member of our Board. | |||

Background

•

•

•

• • Certified Public Accountant (inactive) |

• B.S. in Accounting, California State Polytechnic University • B.S. in Computer Information Systems, California State Polytechnic University Qualification Highlights: • Executive Leadership

• Real Estate Experience

• Treasury/Capital Allocation • Finance/Accounting/Auditing

• Corporate Governance • Human Capital Management

• Consumer Experience

• Risk Assessment & Management

•

• Technology | |||

• Philanthropic Activities • Capital Markets • Cybersecurity • Government Affairs / Regulatory • ESG • Public Company Board | ||||

12 | AMH |

Age:

Trustee since:

Committees • • Human Capital and |

Mr. Benham has extensive management, corporate governance, executive and employee compensation and consumer products experience as a leader of restaurant businesses. His experience, qualifications, attributes, and skills qualify him to serve as chair of our Nominating and Corporate Governance committee, a member of our Human Capital and Compensation Committee and as a member of our Board. | |||

Background

•

• • Arby’s Restaurant • RTM Restaurant Group, Inc., Chief Financial Officer

|

•

• Real Estate Experience

• Treasury/Capital Allocation

• Finance/Accounting/Auditing

• Consumer Experience • Human Capital Management • Corporate Governance • ESG • Risk Assessment & Management

• Investor Relations

• Public Company Board • Public Company Senior Management Experience • Audit Committee • Capital Markets • Philanthropic Activities | |||

Age:

Trustee since:

|

Mr. Corrigan has deep expertise in the residential and commercial real estate sectors, managing large-scale property portfolios, and he was the architect of our AMH Development homebuilding arm. His experience, qualifications, attributes, and skills qualify him to serve as a member of our Board. | |||

Background

•

•

•

• • Arthur Young & Company |

• B.S. in Accounting, Loyola Marymount University Qualification Highlights: • Executive Leadership

• Real Estate Experience

• Treasury/Capital Allocation

•

•

•

• Public Company Senior Management Experience • Capital Markets | |||

2023 Proxy Statement | 13

David Goldberg Age: 73 Trustee since: 2019 Independent | Retired Executive Vice President, AMH Former Senior Vice President and General Counsel, Public Storage Mr. Goldberg brings to our Board expertise in management and legal matters including corporate governance, securities, capital markets and risk management for public and private real estate companies. His experience, qualifications, attributes, and skills qualify him to serve as a member of our Board. | |||

Background • AMH, Executive Vice President (2012-2019) • American Commercial Equities, Executive Vice President (2011-2019) • Public Storage (NYSE: PSA), Senior Vice President and General Counsel • Law Firm of Sachs & Phelps, Partner • Law Firm of Agnew, Miller & Carlson, Associate and Partner • Law Firm of Hufstedler, Miller, Carlson & Beardsley, Partner | ||||

Education • A.B. in History and Social Studies, Boston University • J.D., University of California, Berkeley Qualification Highlights: • Executive Leadership • Real Estate Experience • Corporate Governance • Risk Assessment & Management • Legal Experience • Public Company Senior Management Experience • Government Affairs / Regulatory • Philanthropic Activities | ||||

Tamara H. Gustavson Age: 61 Trustee since: 2016 Independent | Real Estate Investor Philanthropist Ms. Gustavson brings to our Board expertise in management, public relations, corporate governance and industry experience from her leadership roles at publicly traded real estate companies as both an executive and board member. Her experience, qualifications, attributes, and skills qualify her to serve as a member of our Board. | |||

Background • American Commercial Equities, Member (since 2005) • Public Storage (NYSE: PSA), Senior Vice President-Administration Public Directorships • Public Storage (NYSE: PSA) (since 2008) | Education • B.S. in Public Affairs, University of Southern California Qualification Highlights: • Executive Leadership • Real Estate Experience • Human Capital Management • Corporate Governance • Public Company Board • Public Company Senior Management Experience • Consumer Experience • Philanthropic Activities | |||

14 | AMH

Age:

Trustee since:

Committees • Audit • Human Capital and Compensation | Former West Region Market Leader and Managing Partner, Deloitte

Ms. Kerrick has deep expertise in finance and accounting, risk management and corporate governance developed over a 35-year career with a leading public accounting firm. She also brings corporate governance expertise from her service at two other publicly traded companies. Ms. Kerrick qualifies as an audit committee financial expert under SEC rules. Her experience, qualifications, attributes, and skills qualify her to serve as a member of our Audit and Human Capital and Compensation Committees and as a member of our Board. | |||

Background • Deloitte, West Region Market Leader (2019 and 2020), Managing Partner – Los Angeles (2010-2020), other positions (1985-2010) Public Directorships • The Beauty Health Company (NASDAQ: SKIN) (since 2021) • LDH Growth Corp I (NASDAQ: LDHA) (since 2021) | Education • B.S. in Accountancy, Northern Arizona University Qualification Highlights: • Executive Leadership • Real Estate Experience • Finance/Accounting/Auditing • Human Capital Management • Consumer Experience • Corporate Governance • Risk Assessment & Management • Technology • Public Company Board • Audit Committee | |||

James H. Kropp Age: 74 Trustee since: 2012 Independent Committees • Audit (Chair) | Retired Chief Investment Officer, SLKW Investments, LLC and Microproperties LLC Mr. Kropp is a seasoned executive, public company director and accounting expert who brings significant real estate industry, capital allocation and risk management expertise to our Board. He also qualifies as an audit committee financial expert under SEC rules. His experience, qualifications, attributes, and skills qualify him to serve as chair of our Audit Committee and as a member of our Board. | |||

Background • SLKW Investments, LLC, Chief Investment Officer (2009-2019) • U.S. Restaurant Properties (Microproperties LLC), Chief Financial Officer • Arthur Young & Company, Licensed as a Certified Public Accountant (1973-1979) Public Directorships • FS KKR Capital Trust (NYSE: FSK) (since 2018) • KKR RE Select Trust (NASDAQ: KRSTX) (since 2021) • Lead Independent Director PS Business Parks Inc. (formerly NYSE: PSB) (retired in April 2021) | Education • B.B.A. in Finance, St. Francis College Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Debt and Equity Capital Markets • Finance/Accounting/Auditing • Risk Assessment & Management • Investor Relations • Corporate Governance • Public Company Board • Public Company Senior Management Experience • Audit Committee • Capital Markets • Cybersecurity | |||

2023 Proxy Statement | 15

Lynn C. Swann Age: 71 Trustee since: 2020 Independent Committees • Audit • Nominating and Corporate Governance |

Mr. Swann is an experienced public company director of both a leading asset manager and a water technology company, which allow him to contribute valuable perspectives on corporate governance, risk management, technology and ESG matters. His experience, qualifications, attributes, and skills qualify him to serve as a member of our Audit and Nominating and Corporate Governance Committees and as a member of our Board. | |||

Background • Swann, Inc., President (since 1976) Public Directorships • Apollo Global Management, Inc. (NYSE: APO) (since 2022) • Evoqua Water Technologies (NYSE: AQUA) (since 2018) | Education • B.A. in Public Relations, University of Southern California Qualification Highlights: • Executive • Real Estate Experience • Treasury/Capital Allocation • Human Capital Management • Corporate Governance • ESG • Public Company Board • Public Company Senior Management Experience • Audit Committee • Government Affairs/Regulatory • Philanthropic Activities | |||

Winifred M. Age: 65 Trustee since: 2019 Independent Committees • Human Capital and Compensation • Nominating and Corporate Governance | Founder, Kestrel Advisors Former Senior Executive, Ticketmaster, and The Walt Disney Company

Ms. Webb brings more than three decades of experience as a seasoned executive of several of the largest entertainment companies in the country and a director of public companies with significant real estate interests. Her executive leadership experience encompasses expertise in human capital management, ESG and investor relations. Her experience, qualifications, attributes, and skills qualify her to serve as a member of our Human Capital and Compensation and Nominating and Corporate Governance Committees and as a member of our Board. | |||

Background

• Kestrel Advisors,

• Tennenbaum Capital Partners, Managing Director

• Ticketmaster Entertainment, Corporate Senior Vice President, Chief Communications & Investor Relations Officer

• The Walt Disney Company, Corporate Senior Vice President of Investor Relations & Shareholder Services, Executive Director for The Walt Disney Company Foundation

Public Directorships

• AppFolio (NASDAQ: APPF)

• Wynn Resorts (NASDAQ: WYNN)

• ABM Industries (NYSE: ABM) |

• B.A., Smith College (with honors)

• M.B.A., Harvard University

Qualification Highlights:

• Executive Leadership

• Real Estate Experience

• Finance/Accounting/Auditing

• Consumer Experience

•

•

• Risk Assessment & Management

• Investor Relations

• Technology

• Public Company Board

• • Audit Committee • Capital Markets • Treasury/Capital Allocation • Cybersecurity • Philanthropic Activities | |||

16 | AMH

Jay Willoughby Age: 64 Trustee since: 2019 Independent Committees • Audit • Nominating and Corporate Governance | Chief Investment Officer, TIFF Investment Management Mr. Willoughby is an accomplished investment manager and brings deep executive, finance, risk management, capital allocation and ESG experience to our Board. His experience, qualifications, attributes, and skills qualify him to serve as a member of our Audit and Nominating and Corporate Governance Committees and as a member of our Board. | |||

Background • TIFF Investment Management, Chief Investment Officer (since 2015) • The Alaska Permanent Fund, Chief Investment Officer • Ironbound Capital Management, Co-Managing Partner • MLIM Equity Funds, Chief Investment Officer, Head of Research • Merrill Lynch Real Estate Fund, Senior Portfolio Manager | Education • B.A., Pomona College • M.B.A. in Finance, Columbia University Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Finance/Accounting/Auditing • Corporate Governance • ESG • Risk Assessment & Management • Investor Relations • Public Company Senior Management Experience • Audit Committee • Financial Literacy • Capital Markets | |||

Age:

Trustee since:

• • Human Capital and | Chief

Mr. Zaist is a seasoned chief executive of home builders with hands-on expertise in a critical part of our business. His responsibilities at the companies he has led have included oversight of financial statements, risk management and executive compensation matters. Mr. Zaist qualifies as an audit committee financial expert under SEC rules. His experience, qualifications, attributes, and skills qualify him to serve as a member of our Audit and Human Capital and Compensation Committees and as a member of our Board. | |||

Background

• The

|

| |||

|

|

| ||||

• William Lyon Homes (formerly NYSE: WLH), President and Chief Executive Officer and member of the Board (2016-2020), President and Chief Operating Officer

Public Directorships

• William Lyon Homes (formerly NYSE: WLH) (2016-2020) | Education

• B.S., Rensselaer Polytechnic Institute |

Qualification Highlights: • Executive Leadership

• Real Estate Experience

• Treasury/Capital Allocation

• Human Capital Management

• Corporate Governance

• Risk Assessment & Management

• Investor Relations

• Capital Markets

• Finance/Accounting/Auditing

• Public Company Board | |||

• Public Company Senior Management Experience • Consumer Experience • Audit Committee • ESG | |||||

2023 Proxy Statement | 17

How We Are Selected, Elected, Evaluated and Refreshed

We believe that our trustees should satisfy a number of qualifications, including demonstrated integrity, a record of personal accomplishments, a commitment to participation in Board activities and other attributes. We also endeavor to have a board that represents a range of qualifications, skills, and depth of experience in areas that are relevant to and contribute to the Board’s oversight of the company’s business.

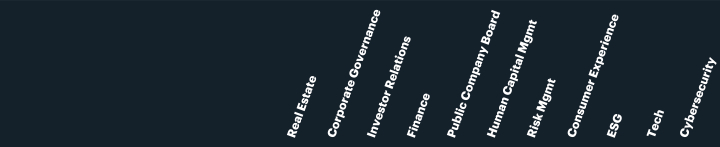

The table below summarizes the key experience, qualifications, and attributes for each trustee nominee and highlights the balanced mix of experience, qualifications, and attributes of the Board as a whole. This high-level summary is not intended to be an exhaustive list of each trustee nominee’s skills or contributions to the Board. No individual experience, qualification, or attribute is solely dispositive of becoming a member of the Board.

| ||||||||||||||||||||||||||||||||||||||||

| Real Estate | Corporate Governance | Investor Relations | Public Company Board | Human Capital Mgt | Consumer Experience | ESG | Diversity | Tech | |||||||||||||||||||||||||||||||

Kenneth M. Woolley | · | · | · | · |

| · |

|

|

| |||||||||||||||||||||||||||||||

Matthew J. Hart | ● | ● | ● | ● | ● | ● | ● | ● |

|

| ● | |||||||||||||||||||||||||||||

David P. Singelyn | · | · | · | · | · | · |

|

| · | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||

Douglas N. Benham | · | · | · | · | · | · | · |

|

| ● | ● | ● | ● | ● | ● | ● | ● | ● |

|

| ||||||||||||||||||||

Jack Corrigan | · |

| · |

|

|

|

|

|

| ● |

| ● | ● |

|

| ● |

|

|

|

| ||||||||||||||||||||

David Goldberg | · | · |

|

|

|

|

|

|

| ● | ● |

|

|

|

| ● |

|

|

|

| ||||||||||||||||||||

Tamara Hughes Gustavson | · |

|

| · | · |

|

| · |

| |||||||||||||||||||||||||||||||

Matthew J. Hart | · | · | · | · | · | · |

|

|

| |||||||||||||||||||||||||||||||

Tamara H. Gustavson | ● | ● |

|

| ● | ● |

| ● |

|

|

| |||||||||||||||||||||||||||||

Michelle C. Kerrick | · |

|

|

| · | · |

| · | · | ● | ● |

| ● | ● | ● | ● | ● |

| ● |

| ||||||||||||||||||||

James H. Kropp | · | · | · | · |

|

|

|

|

| ● | ● | ● | ● | ● |

| ● |

|

|

| ● | ||||||||||||||||||||

Lynn C. Swann | · | · |

| · | · |

| · | · |

| ● | ● |

| ● | ● |

|

| ● |

|

| |||||||||||||||||||||

Winifred M. Webb | · | · | · | · | · | · | · | · | · | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||

Jay Willoughby | · | · | · |

|

|

| · |

|

| ● | ● | ● | ● |

|

| ● |

| ● |

|

| ||||||||||||||||||||

Matthew R. Zaist | · | · | · | ● | · | · |

|

|

| ● | ● | ● | ● | ● | ● | ● | ● | ● |

|

| ||||||||||||||||||||

| 13 | 10 | 9 | 9 | 8 | 7 | 4 | 4 | 3 | 12 | 11 | 8 | 9 | 9 | 7 | 10 | 7 | 6 | 3 | 4 | ||||||||||||||||||||

18 | AMH |

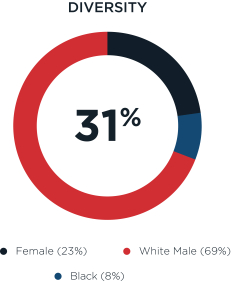

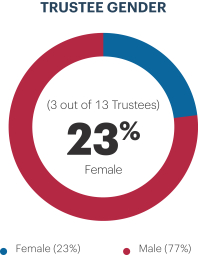

Trustee Ethnic/Racial Diversity. Diversity and inclusion are values embedded in our culture and fundamental to our business. We believe that a Boardboard comprised of trustees with diverse backgrounds, experiences, perspectives and viewpoints improves the dialogue and decision-making in the board room and contributes to overall Boardboard effectiveness.

The Board strives to achieve a wide range of perspectives by having a Board composed of diverse trustees. We look for each trustee to contribute to the Board’s overall diversity—diversity being broadly construed to mean a variety of identities, perspectives, personal and

professional experiences and backgrounds. This can be represented in

both visible and non-visible characteristics that include but are not limited to race, ethnicity, national origin, gender and sexual orientation.

Although the Board does not establish specific goals with respect to diversity, the Board’s overall diversity is a significant consideration in the trustee nomination process. The Board assesses the effectiveness of its approach to Board diversity as part of the Board and committee evaluation process. In order to further advance the Board’s diversity, the Nominating and Corporate Governance Committee requires that any candidate list from a professional search firm include diverse candidates (i.e., Rooney Rule).

|   |

|  |

2023 Proxy Statement | 19

| Race/Ethnicity | Gender | |||||||||||||

| African American or Black | Alaska Native or Native American | Asian | Hispanic or Latino/a | White | Female | Male | |||||||

Matthew J. Hart |  | ● | ● | |||||||||||

David P. Singelyn | ● | ● | ||||||||||||

Douglas N. Benham | ● | ● | ||||||||||||

Jack Corrigan | ● | ● | ||||||||||||

David Goldberg | ● | ● | ||||||||||||

Tamara H. Gustavson | ● | ● | ||||||||||||

Michelle C. Kerrick | ● | ● | ||||||||||||

James H. Kropp | ● | ● | ||||||||||||

Lynn C. Swann | ● | ● | ||||||||||||

Winifred M. Webb | ● | ● | ||||||||||||

Jay Willoughby | ● | ● | ||||||||||||

Kenneth M. Woolley | ● | ● | ||||||||||||

Matthew R. Zaist | ● | ● | ||||||||||||

Board Composition. Our Board currently consists of thirteen members. Upon the recommendation of our Nominating and Corporate Governance Committee, our Board annually nominates trustees for election or re-election to the Board to serve for a one-year term beginning with the Annual Meeting or until their successors, if any, are elected or appointed.

Other than Mr. Woolley, who is retiring from our Board after the 2023 Annual Meeting pursuant to our Trustee Retirement Policy, each of our current trustees was nominated by the Board upon the recommendation of the Nominating and Corporate Governance Committee, and no trustee was nominated by a shareholder or subject to any agreement with any third party.

Led by our Nominating and Corporate Governance Committee, our Board continues to focus on facilitating a smooth transition when trustees retire or leave the Board, as well as ensuring that the composition of our Board is systematically refreshed to maintain the desired mix of skills, experience, independence and diversity to support our strategic direction and operating environment. Since

the beginning of 2020, we have added three new trustees, all of whom qualify as independent under the rules of the New York Stock Exchange (“NYSE”) and bring extensive operational and executive experience to the Board, and two of whom are diverse.

Among other aspects of the succession planning and refreshment process, our Board:

| • | Identifies the collective mix of desired skills, experience, knowledge, diversity and independence of our Board taken as a whole, and identifies potential opportunities for enhancement in these areas; |

| • | Considers each current trustee’s experience, skills, principal occupation, reputation, independence, committee membership and diversity (including age, tenure, geographic, gender and ethnicity); |

| • | Engages third-party search firms to assist with identifying and evaluating qualified candidates, as appropriate; and |

| • | Considers the recommendations of Board members and third parties to identify and evaluate potential trustee candidates. |

Additional information concerning the trustee nomination and selection process is provided below in “Identifying and Evaluating Nominees for Trustee.”

20 | AMH

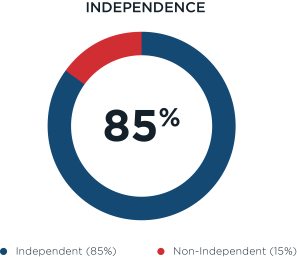

Trustee Independence. The Board evaluates the independence of each trustee annually based on information supplied by trustees and the company and on the recommendations of the Nominating and Corporate Governance Committee. The company’s Corporate Governance Guidelines require that a majority of the trustees be independent in accordance with the requirements of the rules of the NYSE.New York Stock Exchange (“NYSE”). Our Board continuesis approximately 85% independent and assuming our trustee nominees are elected, approximately 83% of our trustees will continue to comply with that requirement, with approximately 77% of the current trustees meetingmeet these independence standards. To promote open discussion among non-management trustees, our non-management and independent trustees devote a portion of each regularly scheduled Board meeting to executive sessions without members of management present. If the group of non-management trustees includes trustees who are not independent, at least one executive session convened per year includes only independent trustees.

No trustee qualifies as independent unless the Board affirmatively determines that the trustee has no material relationship with the company and its management, based on all relevant facts and circumstances, in accordance with NYSE rules. Material relationships may include commercial, industrial, consulting, legal, accounting, charitable, family and other business, professional and personal relationships.

Following its annual review of each trustee’s independence in February 2021,2023, the Nominating and Corporate Governance Committee recommended to the Board and the Board determined that (1) each member of the Board, other than David P. Singelyn and Jack Corrigan, and David Goldberg, and (2) each member of the Audit Committee, the Human Capital and Compensation Committee and the Nominating and Corporate Governance Committee is independent pursuant to the rules of the NYSE.

In determining Ms. Gustavson’s independence, the Board considered, among other things, (i) that loans payable to Ms. Gustavson by each of Messrs. Singelyn and Corrigan which were secured by company securities were repaid in 2019, and (ii) that Mr. Singelyn no longer serves as manager of HF Investments 2010, LLC, which comprises trusts established by B. Wayne Hughes for certain of his heirs, including the children of Ms. Gustavson.

In addition, the Board has determined that:

| • | Each member of the Audit Committee meets the additional independence requirements set forth in Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules of the Securities and Exchange Commission (“SEC”) thereunder; and |

| • | Each member of the Human Capital and Compensation Committee meets the NYSE’s heightened independence requirements for compensation committee members. |

Trustee Retirement Policy. To encourage refreshment of the Board, the Board has adopted a mandatory retirement agepolicy for trustees of 75.trustees. The policy provides in relevant part that no trustee will be nominated for election to the Board unless he or she will be 75 or younger on the first day of such Board term.

Board Orientation and Education. Each new trustee participates in an orientation program and receives materials and briefings concerning our business, strategy, industry, management and corporate governance policies and practices. We provide continuing education for all trustees through board materials and presentations, including presentations by third-party experts, discussions with management, and the opportunity to attend external board education programs. For example, recent Board presentations by third-party experts have covered human capital management and government relations. In addition, all Board members have the opportunity to become a member of the National Association of Corporate Directors and to access the many educational resources of that organization.

Shareholder Recommendations. The policy of the Nominating and Corporate Governance Committee to consider properly submitted shareholder recommendations for candidates for membership on the

|

Board is described below under “Identifying and Evaluating Nominees for Trustee.” Under this policy, shareholder recommendations may only be submitted by a shareholder entitled to submit shareholder proposals under the SEC rules. Any shareholder recommendations proposed for consideration by the Nominating and Corporate Governance Committee should include the nominee’s name and qualifications for Board membership, including the information required under Regulation 14A under the Exchange Act and our bylaws, and should be addressed to the Secretary at our principal executive offices at American Homes 4 Rent, 23975 Park Sorrento, Suite 300, Calabasas, California 91302.AMH, 280 Pilot Road, Las Vegas, Nevada 89119. Recommendations for consideration at the 20222023 Annual Meeting of Shareholders should be submitted within the time frame described in this proxy statement under “Deadlines for receipt of shareholder proposals.”

Trustee Qualifications. Members of the Board shall have the highest personal and professional integrity, shall have demonstrated exceptional ability and judgment and shall be highly effective, in conjunction with the other nominees to the Board, in serving the long-term interests of the company and its shareholders. In general, the Board seeks to add trustees who meet the independence requirements of the NYSE rules. In addition, trustee candidates must submit a completed trustee questionnaire concerning matters related to independence determination, the determination of whether a candidate qualifies as an audit“audit committee financial expertexpert” and other proxy disclosure matters and must satisfactorily complete a background investigation by a third-party firm.

The Board has delegated to the Nominating and Corporate Governance Committee responsibility for recommending to the Board new trustees for election and assessing the skills and characteristics required of Board members in the context of the current make-up of the Board. This

2023 Proxy Statement | 21

assessment includes trustees’ qualifications as independent, and may include consideration of the following, all in the context of an assessment of the perceived needs of the Board at that time:

| • | diversity, background, skills and experience; |

| • | personal qualities and characteristics, accomplishments and reputation in the business community; |

| • | knowledge and contacts in the communities in which the company conducts business and in the company’s industry or other industries relevant to the company’s business; |

| • | ability and willingness to devote sufficient time to serve on the Board and committees of the Board; |

| • | knowledge and expertise in various areas deemed appropriate by the Board; and |

| • | how the individual’s skills, experience and personality fit with those of other trustees in maintaining an effective, collegial and responsive Board. |

When recommending trustee nominees, the Nominating and Corporate Governance Committee considers each nominee’s attendance record at our Board and committeescommittee meetings, track record of the Board;

We do not have a formal diversity policy, and there are no other policies or guidelines that limit the selection of trustee candidates by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee and the Board have and exercise broad discretion to select trustee candidates who will best serve the Board, the company and its shareholders. In order to further advance the Board’s diversity, the Nominating and Corporate Governance Committee requires that any candidate list from a professional search firm include diverse candidates (i.e., Rooney Rule).

The Board recognizes the importance of diversity in the boardroom and plans to continue to follow the corporate

Rooney Rule when conducting searches for future trustee nominees. The Board intends to increase the representation of women and underrepresented communities as it considers board refreshment in the coming years, particularly as members of our Board reach our retirement age.

Identifying and Evaluating Nominees for Trustee. The Nominating and Corporate Governance Committee periodically assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee will consider various potential candidates for trustee.

Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, professional search firms, shareholders or other persons. These candidates will be evaluated at meetings of the Nominating and Corporate Governance Committee and may be considered at any point during the year.

The Nominating and Corporate Governance Committee will consider properly submitted shareholder nominations of candidates for the Board in the same manner as other candidates. Following verification of the shareholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating and Corporate Governance Committee prior to the issuance of the proxy statement for the annual meeting. If any materials are provided by a shareholder in connection with the recommendation of a trustee candidate, such materials are forwarded to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee may also review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a shareholder. In evaluating such nominations, the Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board.

As discussed above in “Board Composition,” the Board has actively focused on refreshment with the addition of three new independent trustees since February 2020. As part of the ongoing process to identify trustee

candidates, during late 2019 and 2020, the Nominating and Corporate Governance Committee reviewed various individual candidates proposed by various Board members, shareholders, investment bankers and a search firm, Ferguson Partners. The nominee selection process involved extensive interviews and five formal meetings of the full Nominating and Governance Committee. At the conclusion of the interview process, the Nominating and Corporate Governance Committee considered feedback from the interviews, discussed the proposed candidates and unanimously recommended that the Board elect Matthew R. Zaist, Lynn C. Swann and Michelle C. Kerrick as trustees. Each of Mr. Zaist, Mr. Swann and Ms. Kerrick were unanimously elected a trustee by the Board in February 2020, August 2020 and September 2020, respectively.

The Board and the Nominating and Corporate Governance Committee will continue to consider additional qualified board candidates.Board candidates to best support the success of the company’s long-term strategy.

How We Are Organized

Our Board is led by the Chairperson, Kenneth M. Woolley, an independent trustee. When Mr. Woolley retires from the Board as of the 2023 Annual Meeting, Mr. Hart, an independent trustee, will assume the role of Chairperson.

Currently, the Board believes that having a separate Chairperson and Chief Executive Officer serves the interests of the company and its shareholders well. Our Board believes that this structure encourages open dialogue and competing views, which promotes strong checks and balances. Mr. Hart’s prior experience as a former president, chief operating officer and chief financial officer of several large public companies and his extensive public company board service will be particularly valuable in his role as Chairperson following the 2023 Annual Meeting. This structure also allows the Chief Executive Officer to focus more

specifically on overseeing the company’s day-to-day operations and long-term strategic planning. If in the future the Board, after considering facts and circumstances at that time, appoints the Chief Executive Officer as Chairperson of the Board, we will promptly publicly disclose the appointment.

Our Board has three standing committees: the Audit Committee, the Human Capital and Compensation Committee and the Nominating and Corporate Governance Committee. Each of these committees consists of at least

three members, each of whom meets the independence standards of the NYSE. Matters put to a vote by any one of our three independent committees of our Board must be approved by a majority of the trustees on the committee who are present at a meeting, in person or as otherwise permitted by our bylaws, at which there is a quorum or by the unanimous written consent of the trustees serving on the committee. Additionally, our Board may from time to time establish other committees to facilitate the Board’s oversight of management of the business and affairs of the company.

Each of the standing committees operates pursuant to a written charter which is reviewed and reassessed annually and that can be viewed on our website at www.americanhomes4rent.comwww.amh.com under “Investor Relations.” A copy of each may be obtained by sending a written request to the company’s Investor Relations Department at American Homes 4 Rent, 23975 Park Sorrento, Suite 300, Calabasas, California 91302,AMH, 280 Pilot Road, Las Vegas, Nevada 89119, or submitting an information request under “Investor Relations” on the company’s website.

Our three standing committees are described below, and the committee members in 2020 and number of meetings held in 20202022 are as follows:

Trustee | Audit Committee | Human Capital and Compensation Committee | Nominating and Governance Committee | |||

Douglas N. Benham |

| Member | Chair | |||

Matthew J. Hart |

| Chair | Member | |||

Michelle C. Kerrick (1) | Member | Member |

| |||

James H. Kropp | Chair |

|

| |||

Lynn C. Swann (1) | Member |

| Member | |||

Winifred M. Webb |

| Member | Member | |||

Jay Willoughby | Member |

| Member | |||

Matthew R. Zaist (1) | Member | Member |

| |||

Number of meetings in 2020: | 4 | 5 | 6 | |||

(1) Mr. Zaist joined the Board in February 2020, Mr. Swann joined the Board in August 2020 and Ms. Kerrick joined the Board in September 2020.

Trustee | Audit Committee | Human Capital and Compensation Committee | Nominating and Governance Committee | |||

Matthew J. Hart (incoming Chairperson of the Board) |

| Chair | Member | |||

Douglas N. Benham |

| Member | Chair | |||

Michelle C. Kerrick | Member | Member |

| |||

James H. Kropp | Chair |

|

| |||

Lynn C. Swann | Member |

| Member | |||

Winifred M. Webb |

| Member | Member | |||

Jay Willoughby | Member |

| Member | |||

Matthew R. Zaist | Member | Member |

| |||

Number of meetings in 2022: | 4 | 4 | 4 | |||

2023 Proxy Statement | 23 |

Audit Committee. Our Board has affirmatively determined that each of the Audit Committee members meets the definition of “independent trustee” for purposes of the NYSE rules and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board has also determined that each member of our Audit Committee is financially literate and that three members, including James H. Kropp, Michelle C. Kerrick and Matthew R. Zaist, qualify as an “audit committee financial expert” under SEC rules and regulations. The Audit Committee’s principal functions consist of overseeing:

| • | the integrity of our consolidated financial statements and financial reporting process; |

| • | our accounting and financial reporting processes; |

| • | our systems of disclosure controls and procedures and internal control over financial reporting; |

| • | our compliance with financial, legal and regulatory requirements; |

| • | the evaluation of the qualifications, independence and performance of our independent registered public accounting firm; |

| • | review of all related party transactions in accordance with our Related Party Transaction Policy; |

| • | the performance of our internal audit functions; and |

| • | our overall risk exposure and management, including with respect to the company’s risk assessment, risk management and risk mitigation policies and programs. |

Human Capital and Compensation Committee. In 2020, the Board made important structural changes to the committee formerly known as the Compensation Committee, repositioned as the Human Capital and Compensation Committee, to expand the responsibilities of such committee to include oversight of the company’s human capital programs and policies, including with respect to diversity and inclusion.

The Human Capital and Compensation Committee’s principal functions consist of supporting the Board in fulfilling its oversight responsibilities relating to the following:

| • | reviewing and approving on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration of our Chief Executive Officer based on such evaluation; |

| • | reviewing and approving the compensation of our other executive officers; |

| • | reviewing our executive compensation policies and plans, including the company’s clawback policies; |

| • | implementing and administering our incentive and equity-based compensation plans; |

| • | reviewing and discussing with management the Compensation Discussion and Analysis (“CD&A”) to be included in the proxy statement and to recommend to the Board the inclusion of the CD&A in the company’s Annual Report on Form 10-K and annual proxy statement; |

| • | producing a report on executive compensation to be included in our annual proxy statement; |

| • | together with management, reviewing management’s annual assessment of potential risks related to compensation policies and practices applicable to all employees; |

| • | overseeing the advisory shareholder votes on the company’s executive compensation programs and policies and the frequency of such votes; |

| • | reviewing, evaluating and recommending changes, if appropriate, to the remuneration for trustees; |

| • | reviewing and reporting to the Board on the company’s programs and practices for talent development and maintaining the continuity of capable management, including but not limited to succession planning for the Chief Executive Officer and other senior executives; and |

| • | overseeing the company’s human capital programs and policies, including with respect to pay fairness and employee well-being, employee retention and development and diversity and inclusion. |

The Human Capital and Compensation Committee may delegate its authority to its members as it deems appropriate. However, any delegate shall report any actions taken by such delegate to the Board the inclusion of the CD&A in the company’s Annual Report on Form 10-Kfull Human Capital and annual proxy statement;

During 2020,2022, the Human Capital and Compensation Committee made all compensation decisions for our executive officers, including the named executive officers (“NEOs”), as set forth in the Summary Compensation Table below. In August 2020,For 2022, the Human Capital and Compensation Committee retained Semler Brossy Consulting Group (“Semler Brossy”) to serve as its new independent, third-party compensation consultant. The Human Capital and Compensation Committee considered Semler Brossy’s advice on a range of compensation matters, including its considerationassessment of possible COVID-19 related adjustments to the 2020 compensation programlabor market conditions and its consideration of enhancements to the 20212023 compensation program, in each case as discussed in more detail in “Executive Compensation” below.

Empowering diverse talent is a key priority for the company, and the Board and the Human Capital and Compensation Committee is actively engaged in overseeing the company’s people and culture. We

recognize employee engagement as a critical factor to our success, and we are committed to creating and maintaining a great place to work with an inclusive culture, competitive benefits and opportunities for training and growth. Moving forward, theThe Human Capital and Compensation Committee will periodically reviewreviews and reportreports to the Board on the company’s programs for attracting, developing and retaining key employees, including management development programs, technology and skills training

24 | AMH

programs, employee health and well-being programs and diversity and inclusion initiatives.